straight life policy calculator

Since the death benefit is 250000 the policy holder. A straight life policy has a level premiumit wont change over the life of your policy.

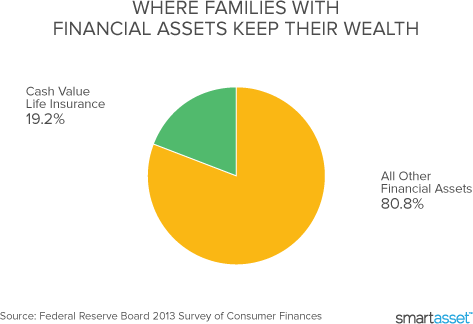

What Is Cash Value Life Insurance Smartasset Com

Determining the precise amount of coverage can be complex but our life insurance calculator helps you analyze your needs and gauge the right amount to.

/GettyImages-184985261-257061c6b35546779a16b51ca1e9da8e.jpg)

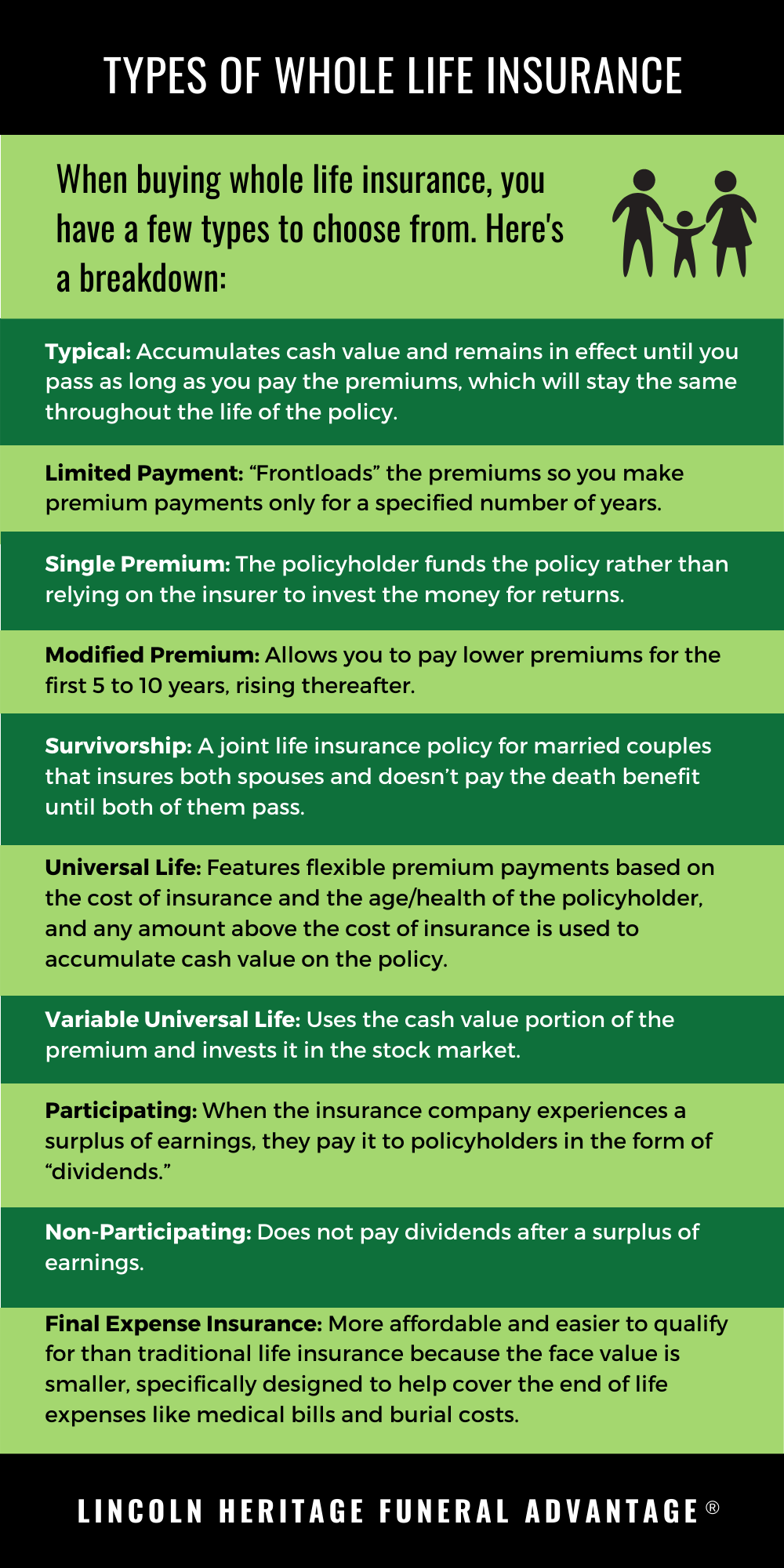

. The term straight refers to the whole life insurance policys premium structure. Estimate the income you will need to replace if you or your partner passed away. Also known as whole life.

Term Life Insurance is a popular and affordable option to secure the financial future of your loved ones. Rural Postal Life Insurance RPLI on the other hand was. Ad Get an instant personalized quote and apply online today.

Ad Offer A Well-Rounded Benefits Package Without Time-Consuming Admin Tasks. Melissa Toby age 36 bought a straight-life insurance policy for 80000. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

The first step in calculating straight line depreciation is calculating the cost of the asset. Term insurance Premium Calculator is a specifically designed tool that helps you determine the actual premium amount that you are required to pay to the insurer for a term life coverage. A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single.

Such as exchanging an annuity. No Medical Exam-Simple Application. Gender Based on Policygenius.

Trusteed For Over 100 Years. Apply for guaranteed acceptance life insurance. With a universal life policy you have the flexibility to.

The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which factors influence it age gender. This is the amount to be paid by life insurance firms. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

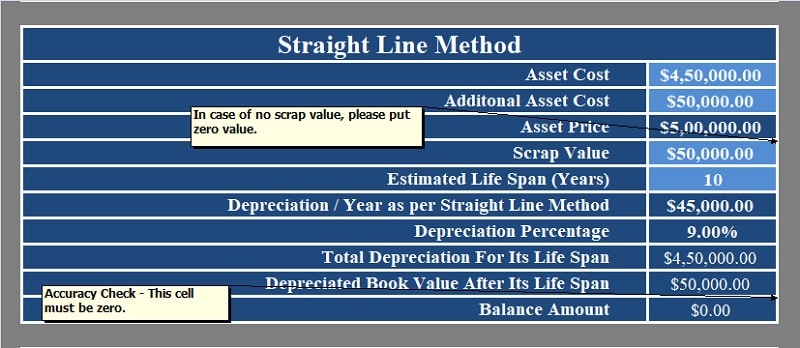

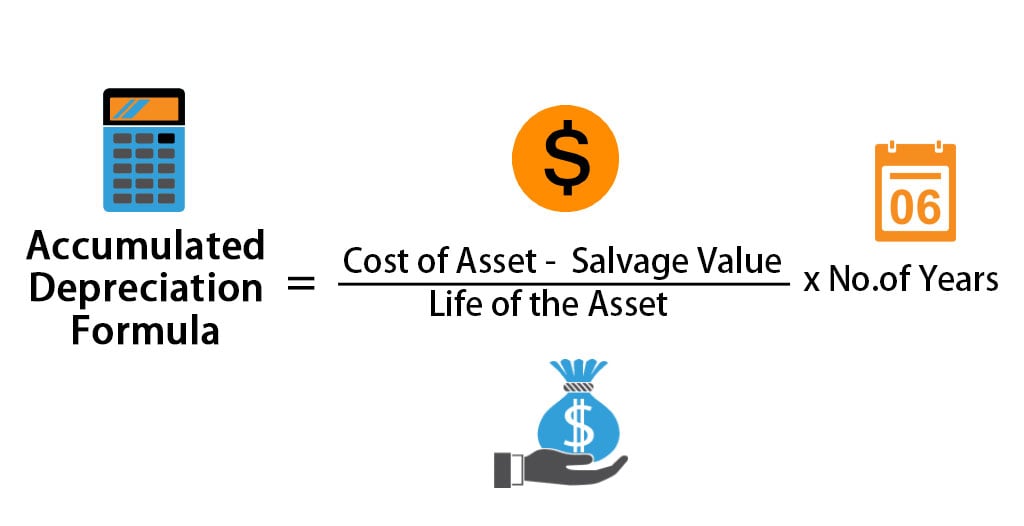

To help aid in your search for a life insurance policy our term life insurance calculator is. A life insurance premium calculator is a tool that provides an approximate amount of insurance premium according to the policy selected by you and other. The straight line calculation as the name suggests is a straight line drop in asset value.

Postal Life Insurance PLI policies were intended to provide affordable insurance coverage to the population of India. The cost of life insurance increases by 45 to 9 each year you put off buying coverage based on policies offered by Policygenius in 2022. Total life insurance needed.

Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Also known as whole or ordinary life. The chart shows 300 for Year 10.

Further whole life insurance rate quotes can be specified as to exam and no exam required carriers. Life Insurance Premium Calculator. Get Your Free Life Settlement Valuation.

A whole life insurance policy builds equity known as cash value and is guaranteed for. You can buy some of our life insurance products online - get a personalized quote. Identify where you are prepared and where you might need to make some adjustments with a customized assessment of your financial plan.

Ad Life Insurance Coverage In 3 Easy Steps. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the. Please check out our article on accelerated underwriting if you prefer whole life.

The depreciation of an asset is spread evenly across the life. Must be between 000 and 9000. Updated Oct 15 2021.

Options start at 995 per month. Request A Quote For Your Business Today. The final cost used in the depreciation.

Reward Employees With Smart Affordable Benefits. Income your family would need to replace if you or. If you have any individual life.

A straight life insurance policy can also build cash value over time. Your state federal tax rate i. Ad Life Insurance You Can Afford.

From 15 A Month. Calculate the cost of the asset. Check out our easy-to-use needs calculator to point you in the right direction.

Term and Whole Life Insurance You Can Rely On. Must be between 5 and 120. As Low As 349 Mo.

Looking to get life insurance but dont know how much coverage you may need. Existing life insurance coverage. All life insurance calculators tools.

While our life settlement calculator provides an estimate up to 892 accurate the most reliable estimate will come from a free thorough assessment. No Medical Exam - Simple Application. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments.

For instance suppose a policy with a 250000 death benefit contains a cash value chart. You cant be turned down due to health.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Download Depreciation Calculator Excel Template Exceldatapro

How Life Insurance Works With Wills And Trusts

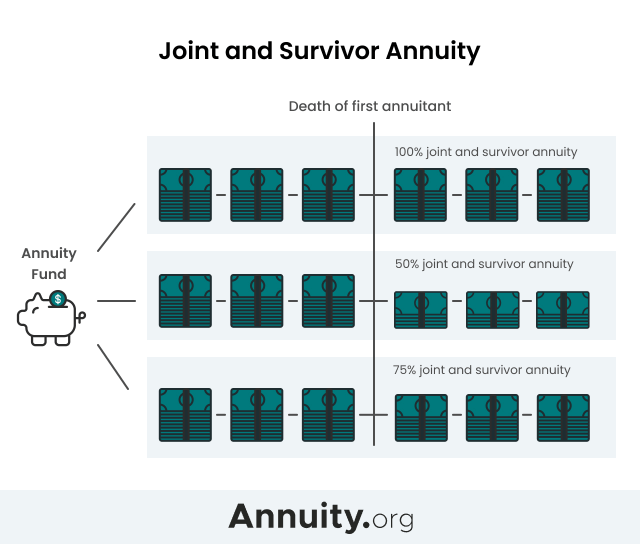

Joint And Survivor Annuity The Benefits And Disadvantages

Whole Life Insurance Quotes Smartasset Com

Double Declining Balance Depreciation Calculator

Life Insurance Calculator Term And Whole Life Aflac

Whole Life Insurance Quotes Smartasset Com

What Is A Straight Life Policy Bankrate

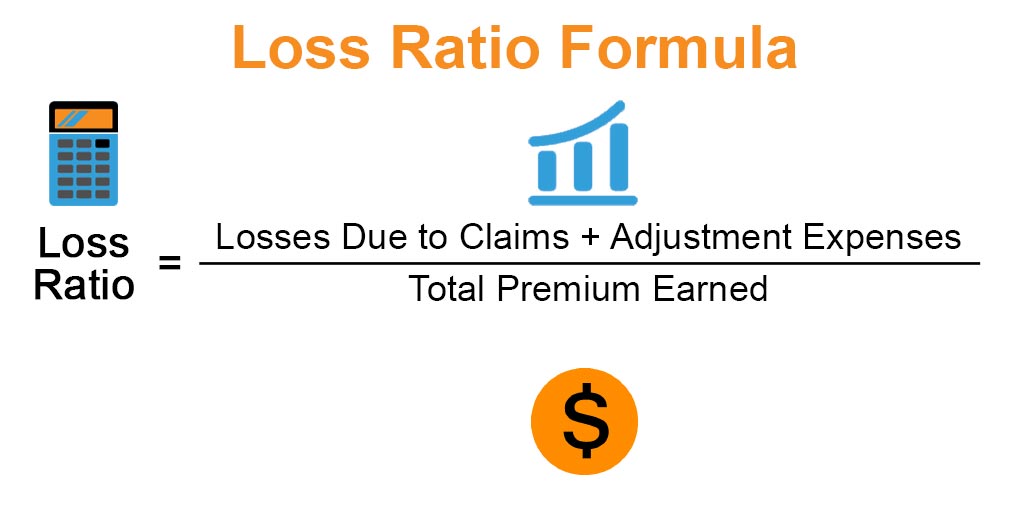

Loss Ratio Formula Calculator Example With Excel Template

What Is A Straight Life Policy Bankrate

What Is Whole Life Insurance Cost Types Faqs

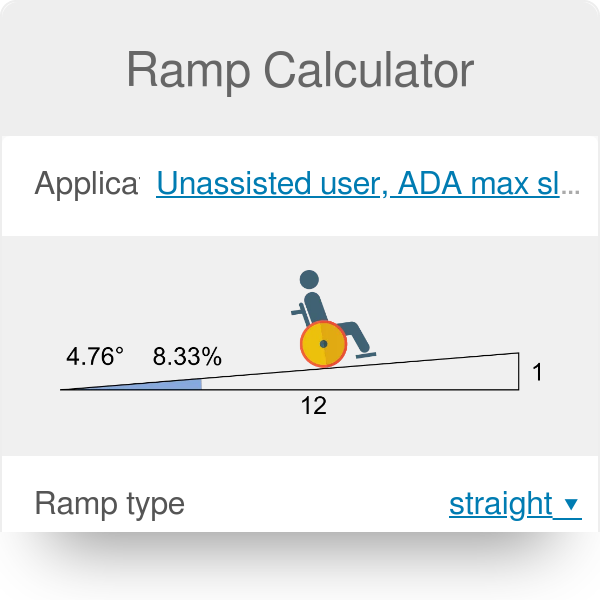

Ramp Calculator Ada Ramp Standards More

What Is A Straight Life Policy Bankrate

Download Depreciation Calculator Excel Template Exceldatapro

The Best Types Of Life Insurance For 4 Life Stages Credit Karma

Accumulated Depreciation Formula Calculator With Excel Template